Defining The Disruptive Geopolitics Of The Global Farms Race

July 6th, 2022

Via GRAIN, a report on how water is often behind the scramble for land in Africa:

Food cannot be grown without water. In Africa, one in three people endure water scarcity and climate change will make things worse. Building on Africa’s highly sophisticated indigenous water management systems could help resolve this growing crisis, but these very systems are being destroyed by large-scale land grabs amidst claims that Africa’s water is abundant, under-utilised and ready to be harnessed for export-oriented agriculture. GRAIN looks behind the current scramble for land in Africa to reveal a global struggle for what is increasingly seen as a commodity more precious than gold or oil: water.

The Alwero river in Ethiopia’s Gambela region provides both sustenance and identity for the indigenous Anuak people who have fished its waters and farmed its banks and surrounding lands for centuries. Some Anuak are pastoralists, but most are farmers who move to drier areas in the rainy season before returning to the river banks. This seasonal agricultural cycle helps nurture and maintain soil fertility. It also helps structure the culture around the collective repetition of traditional cultivation practices related to rainfall and rising rivers as each community looks after its own territory and the waters and farmlands within it.

One new plantation in Gambela, owned by Saudi-based billionaire Mohammed al-Amoudi, is irrigated with water diverted from the Alwero River. Thousands of people depend on Alwero’s water for their survival and Al-Moudi’s industrial irrigation plans could undermine their access to it. In April 2012, tensions over the project spilled over, when an armed group ambushed Al-Amoudi’s Saudi Star Development Company operations, leaving five people dead.

The tensions in south western Ethiopia illustrate the central importance of access to water in the global land rush. Hidden behind the current scramble for land is a world-wide struggle for control over water. Those who have been buying up vast stretches of farmland in recent years, whether they are based in Addis Ababa, Dubai or London, understand that the access to water they gain, often included for free and without restriction, may well be worth more over the long-term, than the land deals themselves.

In recent years, Saudi Arabian companies have been acquiring millions of hectares of lands overseas to produce food to ship back home. Saudi Arabia does not lack land for food production. What’s missing in the Kingdom is water, and its companies are seeking it in countries like Ethiopia.

Indian companies like Bangalore-based Karuturi Global are doing the same. Aquifers across the sub-continent have been depleted by decades of unsustainable irrigation. The only way to feed India’s growing population, the claim is made, is by sourcing food production overseas, where water is more available.

“The value is not in the land,” says Neil Crowder of UK-based Chayton Capital which has been acquiring farmland in Zambia. “The real value is in water.” [1]

And companies like Chayton Capital think that Africa is the best place to find that water. The message repeated at farmland investor conferences around the globe is that water is abundant in Africa. It is said that Africa’s water resources are vastly under utilised, and ready to be harnessed for export oriented agriculture projects.

The reality is that a third of Africans already live in water-scarce environments and climate change is likely to increase these numbers significantly. Massive land deals could rob millions of people of their access to water and risk the depletion of the continent’s most precious fresh water sources.

All of the land deals in Africa involve large-scale, industrial agriculture operations that will consume massive amounts of water. Nearly all of them are located in major river basins with access to irrigation. They occupy fertile and fragile wetlands, or are located in more arid areas that can draw water from major rivers. In some cases the farms directly access ground water by pumping it up. These water resources are lifelines for local farmers, pastoralists and other rural communities. Many already lack sufficient access to water for their livelihoods. If there is anything to be learnt from the past, it is that such mega-irrigation schemes can not only put the livelihoods of millions of rural communities at risk, they can threaten the freshwater sources of entire regions. (See Water mining, the wrong type of farming and Death of the Aral Sea)

Next: When the Nile runs dry….

When the Nile runs dry….

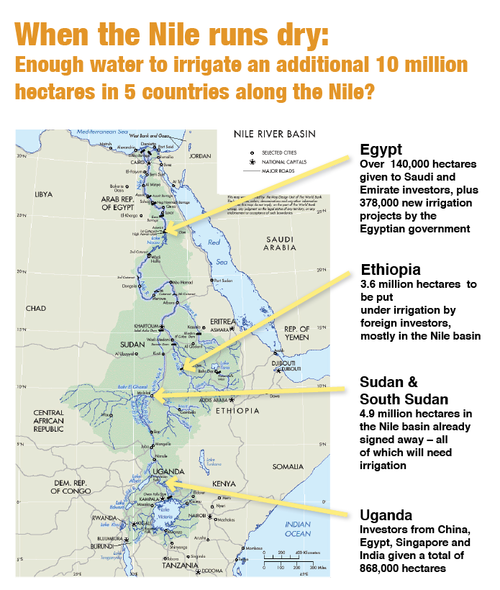

Few countries in Africa have received more foreign interest in their farmland than those served by the Nile River. Africa’s longest river, the Nile is a lifeline especially for Egypt, Ethiopia, South Sudan, Sudan and Uganda and is already a source of significant geopolitical tensions aggravated by the numerous large-scale irrigation projects in the region. In 1959, Great Britain brokered a colonial deal that divided the water rights between Sudan and Egypt. Egypt gained more than Sudan while other countries were excluded completely. Egypt was allocated three quarters of the average annual flow while Sudan was allocated a quarter. Massive irrigation schemes were built in both countries to grow cotton for export to the UK. In the 1960s, Egypt built the mighty Aswan dam to regulate the flow of the Nile in Egypt, and increase opportunities for irrigation. The dam achieved those goals, but also stopped the flow of nutrients and minerals that fertilised the soil of Egypt’s farmers downstream.

In Sudan, the Gulf States financed a further increase of irrigation infrastructure along the Nile in the 1960-70s in an effort to turn Sudan into the ‘breadbasket of the Arab world’. This was unsuccessful and half of Sudan’s irrigation infrastructure currently lies abandoned or underused. Both Sudan and Egypt produce most of their food from irrigated agriculture, but both also face serious problems with soil degradation, salinisaton, water logging and pollution induced by the irrigation schemes. As a result of all these interventions, the Nile barely delivers water to the Mediterranean any longer – instead now, salty seawater backs into the Nile delta, undermining agricultural production.

The economically, ecologically and politically fragile Nile basin is now the target of a new wave of large-scale agriculture projects. Three of the main countries in the basin – Ethiopia, South Sudan and Sudan – have together already leased out millions of hectares in the basin, and are putting more on offer. To bring this land into production, all of it will need to be irrigated. The first question that should be asked is whether there is enough water to do this. But none of those involved in the land deals, be it the land grabbers or those offering lands to grab, seem to have given the question much thought. The assumption is that there is plenty of water and the newcomers can withdraw as much as they need.

Ethiopia is the source of some 80% of the Nile water. In its Gambela region on the border with South Sudan, corporations such as Karaturi Global and Saudi Star are already building big irrigation channels that will increase Ethiopia’s withdrawal of water from the Nile enormously. These are only two of the actors involved. One calculation suggests that if all the land that the country has leased out is brought under production and irrigation, it will increase the country’s use of freshwater resources for agriculture by a factor of nine.[2]

Further downstream, in South Sudan and Sudan, some 4.9 million hectares of land has been leased out to foreign corporations since 2006. That is an area greater than the entire Netherlands. To the north, Egypt is also leasing out land and implementing its own new irrigation projects. It remains to be seen how much of all this will actually be brought into production and put under irrigation, but it is difficult to imagine that the Nile can handle this onslaught.Reliable figures on how much irrigation is actually possible and sustainable are difficult to find. The FAO, in various publications and in its Aquastat database, gives figures on ‘irrigation potential’ and actual irrigation by country and river basin. The table below presents the figures for the major countries in the Nile basin, and compares them with the amount of land already leased out.

Table 1: The Nile Basin: Irrigation, irrigation potential & leased land – figures in numbers of hectares

Country Irrigation potential Already irrigated Leased out since 2006 surplus/deficit Comments Ethiopia 1,312,500 84,640 3,600,000[3] -2,372,140 The irrigation potential refers here to the ‘economic potential’ of the Nile Basin in Ethiopia, which does not take into account the availability of water. According to FAO the whole of Ethiopia has an irrigation potential of 2.7 million hectares taking into account water and land resources. The vast majority of the leased out land in the Nile basin. Sudan & South Sudan 2,784,000 1,863,000 4,900,000 -3,979,000 Virtually all of the water is from the Nile. FAO-Aquastat states that in 2000, the total area equipped for irrigation was 1,863,000 hectares, but only about 800,000 hectares, or 43 percent of the total area, are actually irrigated owing to deterioration of the irrigation and drainage infrastructures. Egypt 4,420,000 3,422,178 140,000 857,822 Virtually all of the water is from the Nile. FAO Aquastat states that plans are underway for new irrigation of 150,000 hectares in Sinai, as part of the al-Salam project, and 228,000 hectares in Upper Egypt at Toshky, amongst others. This would bring the country quickly to its irrigation potential – or over it. Total for all four countries 8,516,500 5,369,818 8,640,000 -5,493,318 FAO, commenting on its own figures, states that the irrigation potential figures should be considered with caution and are probably much lower. It puts the overall irrigation potential of all countries in the Nile basin at around 8 million hectares, but ‘even these 8 million hectares are still a very optimistic estimate and should be considered as a maximum value’ Source: Irrigation figures from FAO Aquastat and FAO: ‘Irrigation potential in Africa: A basin approach’ Land lease figures from GRAIN dataset on land grabbing 2012 and other sources.

The figures have to be considered with some caution. A limitation to the FAO irrigation figures is that they rely on data provided by individual countries. Criteria on how they were established vary widely – some focus on the available land and others on the available water, yet others on the economic costs. Moreover, the ‘potential’ doesn’t take into account that countries upstream might overdraw on their water resources, which would affect the amount of water countries downstream would receive. And it remains to be seen whether all the land leased out will actually be brought under production and irrigation as companies pull out, projects collapse or if the land is just being acquired for speculation purposes.

Nevertheless, the FAO figures do make it clear that the recent land deals vastly outstrip water availability in the Nile basin. FAO establishes 8 million hectares as the total ‘maximum value’ available for total irrigation in all ten countries of the Nile basin. But the four countries listed in the table alone already have irrigation infrastructure established for 5.4 million hectares and have now leased out a further 8.6 million hectares of land. This would require much more water than what is available in the entire Nile basin and would amount to nothing less than hydrological suicide.

Water availability is a highly seasonal affair for most people in Africa. But Africa’s dry and wet seasons are hidden by the ‘averages’ and ‘potentials’ of the quoted figures. Most of the 80% of the Nile water that originates in the Ethiopian highlands falls from the sky and flows into the river between June and August. Local communities have adapted their farming and pastoral systems to make optimum use of the seasonal fluctuations. But the new landowners from abroad want water all year round, with several harvests per year if possible. They will build more canals and dams to make that possible. They also tend to grow crops that need massive amounts of water, such as sugarcane and rice. In all, this means that they’ll consume much more than the potentials and averages suggest, putting the FAO figures quoted above in an even more alarming light.

Next: The Niger, another lifeline at risk

Malibya, a subsidiary of Libya’s sovereign wealth fund, acquired a 50-year renewable lease covering 100,000 ha in the Office du Niger. The Malian government provided the land for free with unlimited access to water for a small user fee. By 2009, Malibya had completed a 40-km irrigation canal, which begins at the same source that feeds all the rice fields of small farmers in the Office du Niger. These small irrigation channels, which used to water the market gardens of the women farmers’ groups in the area, were closed when the Malibya canal was constructed.[i] Although the project was suspended when the Kadhafi regime collapsed in 2011, representatives of Libya’s new government were in Mali in January 2012, to reassure Malian authorities that they would maintain “good” investments in the country.[ii][i] Oakland Institute and Polaris Institute, Dec 2011: Land Grabs Leave Africa Thirsty[ii] GRAIN, 2012 data sets on landgrabbing

Malibya, a subsidiary of Libya’s sovereign wealth fund, acquired a 50-year renewable lease covering 100,000 ha in the Office du Niger. The Malian government provided the land for free with unlimited access to water for a small user fee. By 2009, Malibya had completed a 40-km irrigation canal, which begins at the same source that feeds all the rice fields of small farmers in the Office du Niger. These small irrigation channels, which used to water the market gardens of the women farmers’ groups in the area, were closed when the Malibya canal was constructed.[i] Although the project was suspended when the Kadhafi regime collapsed in 2011, representatives of Libya’s new government were in Mali in January 2012, to reassure Malian authorities that they would maintain “good” investments in the country.[ii][i] Oakland Institute and Polaris Institute, Dec 2011: Land Grabs Leave Africa Thirsty[ii] GRAIN, 2012 data sets on landgrabbing

The Niger, another lifeline at risk

Another part of Africa targeted by agribusiness are the lands along the Niger River. The Niger is West Africa’s largest river, and the third longest in all of Africa, surpassed only by the Nile and the Congo. Millions rely on it for agriculture, fishing, trade and as a primary water source. Mali, Niger and Nigeria are the countries most dependent on the river, but seven other countries in the Niger basin share its water. The river is extremely fragile and has suffered under the strain of human-made dams, irrigation and pollution. Water experts estimate that the volume of the Niger has shrunk by one third during the last three decades alone. Others indicate that the river might lose another third of its flow as a consequence of climate change.[4]

In Mali, the river spreads out into a vast inland delta which constitutes Mali’s main agricultural zone and one of the region’s most important wetlands. It is here that the ‘Office du Niger’ is located and where many of the land grabbing projects are concentrated. The Office du Niger presides over the irrigation of over 70,000 hectares, mainly for the production of rice. It is the largest irrigation scheme in West Africa, and it uses a substantial part of all the river’s water, especially during the dry season.

In the 1990s, the FAO estimated Mali’s potential to irrigate from the Niger at a bit over half a million hectares.[5] But now, due to increased water scarcity, independent experts conclude that the whole of Mali has the water capacity to irrigate only 250,000 hectares.[6] Yet the Malian government has already signed away 470,000 hectares to foreign companies from Libya, China, the UK, Saudi Arabia and other countries in the past few years, virtually all of it in the Niger basin. In 2009, it announced that it would further increase the allowable area of irrigated lands in the country by a mind boggling one to two million hectares.

A study by Wetlands International calculates that, with the effects of climate change and the planned water infrastructure projects, more than 70% of the floodplains of the inner Niger delta will be lost, with a dramatic impact on Mali’s ability to feed its people.[7] Those who will suffer the most are the more than one million local farmers and pastoralists in the Inner Niger Delta that now depend on the river and it’s inner delta for their crops and herds.

Next: Hydro-colonialism?

Virtual water

Agriculture is the most important use of freshwater in the world. In many countries the production of food and other agricultural commodities accounts for over 80% of fresh water use. Experts have labelled this as “virtual water”: the amount of water that is embedded in food or other products needed for its production. The amounts are huge. For example, to produce one kilogram of wheat we need about 1,000 litres of water, so the virtual water of this kilogram of wheat is 1,000 litres. For meat, we need about five to ten times more. To produce enough coffee beans for one cup of coffee requires 140 litres of water. The quantity of water required to grow enough coton to produce a single pair of jeans is a whopping 5,400 litres. [i]

Trade in agricultural commodities thus amounts to trade in virtual water. Neo-liberal economists argue that the international trade in agricultural commodities is the most efficient way to save water, as crops can be grown where water requirements are less, ie in countries where you don’t need irrigation because it rains a lot. But the reality of the virtual water trade is starkly different. Europe, not a notoriously dry continent, is one of the main importers of virtual water in the world, often from places that regularly experience droughts and shortages. For the United Kingdom it is estimated that two-thirds of all the water that its population needs comes embedded in imported food, clothes and industrial goods. The result is that when people buy flowers from Kenya, beef from Botswana, or fruit and vegetables from parts of Asia and Latin America, they may be exacerbating droughts and undermining countries’ efforts to grow food for themselves.[ii]

[i] See: www.virtual-water.org

[ii] John Vidal, the Guardian, 17 April 2010. “UK relies on ‘virtual’ water from drought-prone countries, says report”

Hydro-colonialism?

The Nile and the Niger basins are only two of the examples of the massive give away of land and water rights. The areas where land grabbing is concentrated in Africa coincide closely with the continent’s largest river and lake systems, and in most of these areas irrigation is a prerequisite of commercial production.

The Ethiopian government is constructing a dam in the Omo river, to generate electricity and irrigate a huge sugarcane plantation; a project that threatens hundreds of thousands of indigenous people that depend on the river further downstream. It also threatens to empty the world biggest desert lake, Lake Turkana, fed by the Omo river. In Mozambique the government had signed off on a 30,000 hectares plantation along the Limpopo river which would have directly affected farmers and pastoralists now depending on the water. The project was revoked because the investor didn’t deliver, but the government is looking for others to take over. In Kenya, a tremendous controversy has arisen from the government’s plans to hand out huge areas of land in the delta of the Tana River with disastrous implications for the local communities depending on the delta’s water. The already degraded Senegal river basin and its delta have been subject to hundreds of thousands of hectares in land deals, putting foreign agribusiness in direct competition for the water with local farmers. The list goes on, and is growing by the day. This table shows a selection of the most important cases.

Peter Brabeck-Letmathe, the Chairman of Nestle, says that these deals are more about water than land: “With the land comes the right to withdraw the water linked to it, in most countries essentially a freebie that increasingly could be the most valuable part of the deal.”[8] Nestle is a leading marketer of bottled water under brand names including Pure Life, Perrier, S.Pellegrino and a dozen others. It has been charged with illegal and destructive groundwater extraction, and of making billions of dollars in profits on cheap water while dumping environmental and social costs onto communities. [9]

In the not-so-distant future, water will become “the single most important physical-commodity based asset class, dwarfing oil, copper, agricultural commodities and precious metals,” says Citigroup’s chief economist, Willem Buiter.[10] No surprise, then, that so many corporations are rushing to sign land deals that give them wide-ranging control over African water. Especially when African governments are essentially giving it away. Corporations understand what’s at stake. There are “buckets of money” to be made on water, if only it can be controlled and turned it into a commodity. (See Virtual water and Grabbing carbon credits?)

The secrecy that shrouds land deals makes it hard to know exactly what’s being handed over to foreign companies. But from those contracts that have been leaked or made public, it is apparent that the contracts tend not to contain any specific mention of water rights at all, leaving the companies free to build dams and irrigation canals at their discretion, sometimes with a vague reference to ‘respecting water laws and regulations’.[11] This is the case in the agreements signed between the Ethiopian government and both Karuturi and Saudi Star in Gambela, for example. In some contracts, a minor user fee is agreed upon for the water, but without any limitation on the amount of water that can be withdrawn. Only in rare cases are even minimal restrictions imposed during the dry season, when access to water is so critical for local communities. But even in instances where governments may have the political will and capacity to negotiate conditions to protect local communities and the environment, this is made increasingly difficult due to existing international trade and investment treaties that give foreign investors strong rights in this respect.[12]

Next : Stop the water grab

Grabbing carbon credits

The agro-industrial group Herakles American Farms leased more than 73,000 hectares of farmland in South West Cameroon to produce oil palm. According to a local NGO, the Center for Environment and Development (CED), the company gets the right to use, free, unlimited quantities of water in its land grant. But Herakles also gets something else with the deal: the right to benefit from any carbon credits that the company can get on its oil palm plantation, with government undertaking to promptly provide “all certificates, consents, authorisation and other support”. Cameroon doesn’t even have a law yet that regulates its carbon trade, but its government already signs away the rights to benefit from the growing international carbon trade. CED rightly asks: “Why give the right to exploit land and the rights for carbon to a business at such a low rent, whereas the State could gain more, without any special investment and transform the area into a REDD project?”[i]

The burgeoning carbon trade market, and it’s related REDD (Reducing Emissions from Deforestation and Forest Degredation) mechanism, could very well make land more attractive as an asset for foreign investors. The UN considers tree plantations as forests, and therefore oil palm and other plantations can benefit from carbon credits. REDD and the carbon trade market have already come under severe criticism for doing the opposite of what they are meant to do: exacerbating instead of diminishing the climate crisis. They also provide yet another incentive for agribusiness and investment funds to get hold of land and water resources across the world.

[i] Samuel Nguiffo, Brandon Schwartz, CED ‘Herakle 13th Labour? A Study of SGSOC’s Land Concession in South-west Cameroun. www.cedcameroun.org/index.php

Stop the water grab

If this land and water grab is not put to an end, millions of Africans will lose access to the water sources they rely on for their livelihoods and their lives. They may be moved out of areas where land and water deals are made or their access to traditional water sources may simply be blocked by newly built fences, canals and dikes. This is already happening in Ethiopia’s Gambela, where the government is forcibly moving thousands of indigenous people out of their traditional territories to make way for export agriculture. By 2013, the government wants to remove 1.5 million people from their territories across Ethiopia.[13] As the bulldozers move into the newly acquired lands, this will become an increasingly common feature in Africa’s rural areas, generating more tensions and conflicts over scarce water resources.

But the impacts will run far beyond the immediately affected communities. The recent wave of land grabbing is nothing short of an environmental disaster in the making. There is simply not enough water in Africa’s rivers and water tables to irrigate all the newly acquired land. If and when they are put under production, these 21st century industrial plantations will rapidly destroy, deplete and pollute water sources across the continent. Such models of agricultural production have generated enormous problems of soil degradation, salinisation and waterlogging wherever they have been applied. India and China, two shining examples that Africa is being pushed to emulate, are now in a water crisis as a result of their Green Revolution practices. Over 200 million people in India and 100 million in China depend on foods produced by the over-pumping of water.[14] Fearing depleted water supplies or perhaps depleted profits, companies from both countries are looking now to Africa for future food production.

Africa is in no shape for such an imposition. More than one in three Africans live with water scarcity, and the continent’s food supplies are set to suffer more than any other’s from climate change. Building Africa’s highly sophisticated and sustainable indigenous water management systems could help resolve this growing crisis, but these are the very systems being destroyed by land grabs.

Advocates of the land deals and mega irrigation schemes argue that these big investments should be welcomed as an opportunity to combat hunger and poverty in the continent. But bringing in the bulldozers to plant water-intensive export crops is not and cannot be a solution to hunger and poverty. If the goal is to increase food production, then there is ample evidence that this can be most effectively done by building on the traditional water management and soil conservation systems of local communities. [15] Their collective and customary rights over land and water sources should be strengthened not trampled.

But this is not about combating hunger and poverty. This is theft on a grand scale of the very resources – land and water – which the people and communities of Africa must themselves be able to manage and control in order to face the immense challenges they face this century.

Going Further

Fred Pearce, The Landgrabbers: The new fight over who owns the Earth, Eden Project, 2012.Fred Pearce, When the rivers run dry: What happens when our water runs out? Eden Project, 2006Water Alternatives, June 2012: Special Issue: Water grabbing? Focus on the (re)appropriation of finite water resourcesTransnational Institute (TNI), March 2012 The global water grab: A primerOakland Institute, December 2011 ‘Landgrabs leave Africa thirsty‘Farmlandgrab.org News and information on large-scale land grabs. Updated daily. Maintained by GRAIN as a research-sharing and monitoring project open to your contributions and participation.

References:

[1]Neil Crowder, CEO Chayton Africa, Zamiba Investment Forum, 2011 http://vimeo.com/38060966

[2] Oakland Institute, December 2011 ‘Landgrabs leave Africa thirsty‘

[3] Estimates of land deal figures for Ethiopia vary wildly. Here we use 3.6 million hectares, as indicated in the 2011 Oakland Institute’s country report on the issue: http://tinyurl.com/br8jz7s In 2012, Ethiopia’s Prime Minister Meles Zenawi announced that the country had made available 4 million hectares to agricultural investors: http://farmlandgrab.org/post/view/20468

[4] Fred Pearce, ‘When the rivers run dry’ Eden Project, 2006. p. 146.

[5] FAO 1997 ‘Irrigation potential in Africa: A basin approach’

[6] Quoted in SIWI, 2012, ‘Land acquisitions: How will they impact transboundary waters?’

[7] Wetlands International. L. Zwarts 2010. “Will the Inner Niger Delta shrivel up due to climate change and water use upstream?

[8] Foreign Policy, 15 April 2009. http://www.foreignpolicy.com/articles/2009/04/15/the_next_big_thing_h20[9] In 2001, residents of the Serra da Mantiqueira region of Brazil, investigating changes in the taste of their water and the complete dry-out of one of their springs discovered that Nestlé/Perrier was pumping huge amounts of water from a 150 meter deep well in a local Circuito das Aguas, or “water circuits” park whose groundwater has a high mineral content and medicinal properties. The water was being demineralized and transformed into table water for Nestlé’s “Pure Life” brand. Water usually needs hundreds of years inside the earth to be slowly enriched by minerals. Overpumping decreases its mineral content for years to come. Demineralisation is illegal in Brazil, and after the Movimento Cidadania pelas Águas, or Citizens for Water Movement mobilised, a federal investigation was opened resulting in charges against Nestlé/Perrier. Nestlé lost the legal action, but continued pumping water while it fought the charges through appeals. http://www.corporatewatch.org.uk/?lid=240#water

[10] Quoted Financial Times/alphaville “Willem Buiter thinks water will be bigger than oil” 21 July 2011. http://ftalphaville.ft.com/blog/2011/07/21/629881/willem-buiter-thinks-water-will-be-bigger-than-oil/

[11] For access to the contracts that we have been able to get hold of, see: http://farmlandgrab.org/home/post_special?filter=contracts[12] The issue of land and water rights in the context of international trade and investment treaties is further discussed in: Carin Smaller and Howard Mann: ‘A thirst for distant lands’, IISD, 2009.

[13] Human Rights Watch, 2012: ‘Waiting here for Death’. http://www.hrw.org/sites/default/files/reports/ethiopia0112web_short.pdf

[14] Fred Pearce, ‘When the Rivers Run Dry’ Eden Project, 2006. See also Water Mining in this article.

[15] For more details and examples, see: Oakland Institute, December 2011 ‘Landgrabs leave Africa thirsty‘ op. cit.

Table 2: Selected African land deals and their water implications |

|

Land deal summary |

Water implications |

| Mozambique, Limpopo river | |

| 30,000 hectares close to Massingir dam leased to Procana for sugarcane production. Project was suspended and government is now looking for new investors. One study puts the total new irrigation plans due to the various land acquisitions at 73,000 hectares | One study concluded that the Limpopo River does not carry sufficient water for all planned irrigation and that only about 44,000 hectares of new irrigation can be developed, which is 60% of the envisaged developments. Any additional water use would certainly impact downstream users and thus create tensions. [1] |

| Tanzania, Wami River | |

| Ecoenergy has been granted a concession of 20,000 hectares to grow sugarcane. The company claims that the size of the project has now been reduced to 8000 hectares. | The Environmental Impact Assessment (EIA) for the project revealed that the amount of water EcoEnergy requested to withdraw from Wami River for irrigation during the dry season was excessive and would reduce the flow of the river. The EIA also predicts an increase in local conflicts related to both water and land.[2] |

| Kenya, Yala Swamp (Lake Victoria) | |

| Dominion Farms (US) established its first farm on a 7,000 hectare piece of land in the Yala Swamp area in Kenya, which it obtained on a 25-year lease. | The local communities living in the area complain of being displaced without compensation, of losing access to water and pasture for their livestock, of losing access to potable water and of pollution from the regular aerial spraying of fertilisers and agrochemicals. They continue to struggle to get their lands back and to get Dominion to leave.[3] |

| Ethiopia/Kenya, Omo River & Turkana lake | |

| The Ethiopian government is building an enourmous dam in the Omo river to produce electricity and to irrigate 350,000 hectares for commercial agriculture, including 245,000 hectares for a huge state-run sugar-cane plantation. Known as ‘Gibe III’, the dam has sparked a tremendous international opposition due to the environmental damage it will cause, and the impact it will have on indigenous people depending on the river. | Descending from the central Ethiopian plateau, the Omo River meanders across Ethiopia’s southwest before spilling into Kenya’s Lake Turkana, the world’s largest desert lake. The Omo River and Lake Turkana is a lifeline for over half a million indigenous farmers, herders and fishermen,, and the Gibe III Dam now threaten their livelihood. Construction of the dam began in 2006. Studies suggest that irrigating 150,000 hectares. would lower Lake Turkana by eight meters by 2024. If 300,000 hectares. are irrigated, the lake level will decline by 17 meters, threatening the very future of the lake which has an average depth of only 30 meters.[4] |

| Ethiopia, Nile River[5] | |

Multiple foreign investors, including the following in the Gambela region:

|

Ethiopia has leased out some 3.6 million hectares. The vast majority of these are in the Nile basin, including the Gambela region. The FAO puts the irrigation potential of the Nile basin in Ethiopia at 1.3 million hectares. So if all the land offered for lease is brought into production and under irrigation, the plantations will draw more water than the Nile can handle. The first ones to lose out are the local communities. The government has started a ‘villagization programme’ in which it is is forcibly relocating approximately 70,000 indigenous people from the western Gambella region to new villages that lack adequate food, farmland, healthcare, and educational facilities. |

| Sudan & South Sudan, Nile River | |

| Multiple investors, including Citadel Capital (Egypt) Pinosso Group (Brazil), ZTE (China), Hassad Food (Qatar), Foras (Saudi Arabia), Pharos (UAE), and others. Total land deals documented by GRAIN amount to 3.5 million hectares in Sudan, and 1.4 million hectares in South Sudan. | Together Sudan & South Sudan have some 1.8 million hectares under irrigation, virtually all of it drawing from the Nile. FAO calculates that, together, Sudan and South Sudan haven an irrigation potential of 2.8 million hectares. But GRAIN identified almost 4.9 million hectares that have been leased out to foreign investors in these two countries since 2006. Of course, considering the recent tense political situation, it remains to be seen whether and when this land is put under production. But even if a part of it is, there is clearly not enough water in the Nile to irrigate it all. |

| Egypt, Nile River | |

| GRAIN documented the acquisition of some 140,000 hectares of farmland by Saudi and UAE agribusiness in Egypt for food and fodder for export by Al Rajhi and Jenat (Saudi Arabia), Al Dahra (UAE) and others | Egypt is fully dependent on the water of Nile for its food production. Currently the country has some 3.4 million ha under irrigation, and FAO calculates that it has an irrigation potential fo 4.4 million ha. It still has to import much of its food. The country is continuously expanding its agricultural area, including the Toshka project to transform 234,000 hectares of Sahara desert into agricultural land in the South, and the Al Salam Canal to irrigate 170,000 hectares in the Sinai, Despite concerns over the needs for water to feed its own population, the Egyptian government has signed off to lease at least 140,000 hectares to agribusiness from the Gulf States to produce food and feed for export. It is difficult to see how this is compatible with feeding its own population. |

| Kenya, Tana River Delta | |

| The government has given tenure rights and ownership of 40,000 hectares of Tana Delta land to TARDA (Tana River Development Authority) who entered into a joint venture with Mumias Sugar company to establish sugarcane plantations. A second sugar company, Mat International, is in the process of acquiring over 30,000 hectares of land in Tana Delta and another 90,000 hectares in adjacent districts. The company has not carried out any environmental or social impact assessments. Bedford Biofuels Inc, from Canada, is seeking for a 45 year lease agreement on 65,000 hectares of land in Tana River District to transform it into biofuel farms, mainly growing Jatropha. | The Tana is Kenya’s largest river. Its delta covers an area of 130,000 hectares and is amongst Africa’s most valuable wetlands. It is home to two dominant tribes, the Orma pastoralists and the Pokomo agriculturalists. According to one study more than 25,000 people living in 30 villages stand to be evicted from their ancestral land that has now been given to TARDA.

The impacts of these intensive agricultural projects are numerous and they raise both environmental and social issues. Even the Environmental Impact Assessment of Mumias questions whether the proposed abstraction of irrigation water from the Tana River can be maintained during dry months and drought periods. Reduced flow could lead to damage of downstream ecosystems, reduced availability for livestock and wildlife and increased conflict, both inter-tribal and between humans and wildlife.[6] |

| Mali, Inner Niger Delta[7] | |

| GRAIN has documented the acquisition of some 470,000 hectares of farmland in Mali by different corporations from all over the world. They include Foras (S. Arabia); Malibya (Libya); Lonrho (UK), MCC (US), Farmlands of Guinea (UK), CLETC (China) and several others. Virtually of this is in the ‘Office du Niger’ located in the Inner Niger Delta, a huge inland delta which constitutes Mali’s main agricultural area. | The FAO puts Mali’s potential to irrigate from the Niger at about half a million hectares. But due to increased water scarcity, independent experts conclude that Mali has the water capacity to irrigate only 250,000 hectares. The government has already signed away rights to 470,000 hectares in the delta – all of it to be irrigated. And it announced that 1 to 2 million hectares more are available. One study by Wetlands International calculates that the combined effects of climate change and all the planned water infrastructure projects will result in the loss of more than 70% of the floodplains of the delta. |

| Senegal, Senegal River basin | |

| GRAIN has documented the acquisition of some 375,000 hectares of farmland by investors from China (Datong Trading), Nigeria (Dangete Industries), S. Arabia (Foras), France (SCL) and India. | A lot of the land deals are in the basin of the Senegal river which is the main irrigated rice producing area of Senegal. Around 120,000 hectares in the area are suitable for irrigated rice production and about half of these are currently being farmed under irrigation. The FAO calculates that the river has a total irrigation potential of 240,000 hectares. Unesco reports that the flood plain ecosystems of the Senegal river are in bad shape due to dam building: “In less than ten years, the degradation of these environments and the consequences on the health of the local population have been dramatic.” Taking more water from the river to produce export crops will make a bad situation worse.[8] |

| Cameroon | |

| The agro-industrial group Herakles American Farms leased more than 73,000 hectares of farmland in South West Cameroon to produce oil palm. | According to local NGOs, the contract gives the company “the right to use, free, unlimited quantities of water in its land grant”. It concludes that from a contractual standpoint the company clearly has priority over local communities when accessing water, and fears that environmental and socio economic impact will be severe. In 2011, the local youth took to the streets to block the bulldozers in protest. The Mayor of Toko, which is in the area is affected by the land deal, drew attention to its impact on the country’s major watershed: “This particular area is one of the most important watersheds of Cameroon. We don’t need SG SOC or Herackles farm in our area.”[9] |

This entry was posted on Wednesday, July 6th, 2022 at 1:50 pm and is filed under Uncategorized. You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.

Educated at Yale University (Bachelor of Arts - History) and Harvard (Master in Public Policy - International Development), Monty Simus has long held a keen interest in natural resource policy and the geopolitical implications of anticipated stresses in the areas of freshwater scarcity, biodiversity reserves & parks, and farm land. Monty has lived, worked, and traveled in more than forty countries spanning Africa, China, western Europe, the Middle East, South America, and Southeast & Central Asia, and his personal interests comprise economic development, policy, investment, technology, natural resources, and the environment, with a particular focus on globalization’s impact upon these subject areas. Monty writes about freshwater scarcity issues at www.waterpolitics.com and frontier investment markets at www.wildcatsandblacksheep.com.

If history has anything to teach us, it is that the industrial agriculture that the land grabbers are now promoting across Africa and the rest of the world is simply not sustainable. In Pakistan, the British Empire built the largest single irrigated area in the world to produce the raw material for the cotton mills back home. After independence, the new government, backed by generous funding from the World Bank, further expanded the dams and canal systems in the mighty Indus river to the extent that the river now waters 90 percent of all the crops in the country. Apart from turning the country into one of the world’s major cotton exporters, the huge irrigation schemes also allowed the country to tremendously expand rice and wheat cultivation using plant varieties and technologiy from the Green Revolution of the 1960s. But there was a price to pay. The Indus carries 22 million tonnes of salt each year, but discharges only 11 million tonnes at its exit into the Arabian Sea. The rest, almost a tonne per year for every irrigated hectare, stays on the farmers’ fields, forming a white crust that kills the crops. So far, a tenth of the fields in Pakistan are no longer usable for agriculture, a fifth are badly waterlogged and a quarter produce only meagre crops. Moreover, the water withdrawal is so intense that in many years the Indus no longer flows all the way into the sea.

If history has anything to teach us, it is that the industrial agriculture that the land grabbers are now promoting across Africa and the rest of the world is simply not sustainable. In Pakistan, the British Empire built the largest single irrigated area in the world to produce the raw material for the cotton mills back home. After independence, the new government, backed by generous funding from the World Bank, further expanded the dams and canal systems in the mighty Indus river to the extent that the river now waters 90 percent of all the crops in the country. Apart from turning the country into one of the world’s major cotton exporters, the huge irrigation schemes also allowed the country to tremendously expand rice and wheat cultivation using plant varieties and technologiy from the Green Revolution of the 1960s. But there was a price to pay. The Indus carries 22 million tonnes of salt each year, but discharges only 11 million tonnes at its exit into the Arabian Sea. The rest, almost a tonne per year for every irrigated hectare, stays on the farmers’ fields, forming a white crust that kills the crops. So far, a tenth of the fields in Pakistan are no longer usable for agriculture, a fifth are badly waterlogged and a quarter produce only meagre crops. Moreover, the water withdrawal is so intense that in many years the Indus no longer flows all the way into the sea. The situation isn’t all that much better in the US. The maize and soybean plantations that dominate the country’s mid-west have already caused the water table to fall substantially. California, with its endless fruit plantations, pumps 15% more water than the rains replenish. But perhaps the situation is nowhere more dramatic than in the Middle East. Saudi Arabia has no rain or rivers to speak of, but posesses vast ‘fossil water’ aquifers beneath the desert. During the 1980s the Saudi government invested $40 billion of its oil revenues to pump this precious water to irrigate a million hectares of wheat. Later, in the 1990s, in order feed the growing industrial dairy farms that popped up across the desert, many farmers switched to alfalfa, a crop that needs even more water. It was clear that the miracle couldn’t last; the aquifers soon collapsed and the government decided to outsource its food production to Africa and other parts of the world instead. Some 60% of the country’s fossil water under the desert was squandered in the process. Gone and lost forever.

The situation isn’t all that much better in the US. The maize and soybean plantations that dominate the country’s mid-west have already caused the water table to fall substantially. California, with its endless fruit plantations, pumps 15% more water than the rains replenish. But perhaps the situation is nowhere more dramatic than in the Middle East. Saudi Arabia has no rain or rivers to speak of, but posesses vast ‘fossil water’ aquifers beneath the desert. During the 1980s the Saudi government invested $40 billion of its oil revenues to pump this precious water to irrigate a million hectares of wheat. Later, in the 1990s, in order feed the growing industrial dairy farms that popped up across the desert, many farmers switched to alfalfa, a crop that needs even more water. It was clear that the miracle couldn’t last; the aquifers soon collapsed and the government decided to outsource its food production to Africa and other parts of the world instead. Some 60% of the country’s fossil water under the desert was squandered in the process. Gone and lost forever. Since the 1960s, the Aral Sea in Central Asia, located in what today is Kazakhstan and Uzbekistan, has been deprived of more water than is necessary to maintain its water levels. It used to be amongst the four largest lakes of the world. The fresh water that once replenished the sea is used by neighbouring countries to produce export crops, mainly cotton. Large amounts of water from the two main rivers that feed the Aral Sea have been diverted to the desert so as to irrigate about 2.5 million hectares of land. In the 1960s, the Aral Sea received around 50 cubic kilometres of fresh water per year. By the early 1980s it received none. By the 1990s, the surface area of the Aral Sea had shrunk by half and its volume had dropped by 75 percent. Its salinity had increased fourfold, preventing the survival of most of the sea’s fish and wildlife. The desiccation of the Aral Sea has led to the loss of fisheries, contamination of water and soil, and the presence of dangerous levels of polluted airborne sediments (salt- and pesticide-laced particles). In addition, the regional groundwater table has fallen and many oases near the shore of the Aral Sea have been destroyed. By 1990, more than 95% of the marshes and wetlands in the region had given way to sand deserts. The inhabitants of the adjacent communities face severe health problems. The infant mortality rate is one of the world’s highest.

Since the 1960s, the Aral Sea in Central Asia, located in what today is Kazakhstan and Uzbekistan, has been deprived of more water than is necessary to maintain its water levels. It used to be amongst the four largest lakes of the world. The fresh water that once replenished the sea is used by neighbouring countries to produce export crops, mainly cotton. Large amounts of water from the two main rivers that feed the Aral Sea have been diverted to the desert so as to irrigate about 2.5 million hectares of land. In the 1960s, the Aral Sea received around 50 cubic kilometres of fresh water per year. By the early 1980s it received none. By the 1990s, the surface area of the Aral Sea had shrunk by half and its volume had dropped by 75 percent. Its salinity had increased fourfold, preventing the survival of most of the sea’s fish and wildlife. The desiccation of the Aral Sea has led to the loss of fisheries, contamination of water and soil, and the presence of dangerous levels of polluted airborne sediments (salt- and pesticide-laced particles). In addition, the regional groundwater table has fallen and many oases near the shore of the Aral Sea have been destroyed. By 1990, more than 95% of the marshes and wetlands in the region had given way to sand deserts. The inhabitants of the adjacent communities face severe health problems. The infant mortality rate is one of the world’s highest.